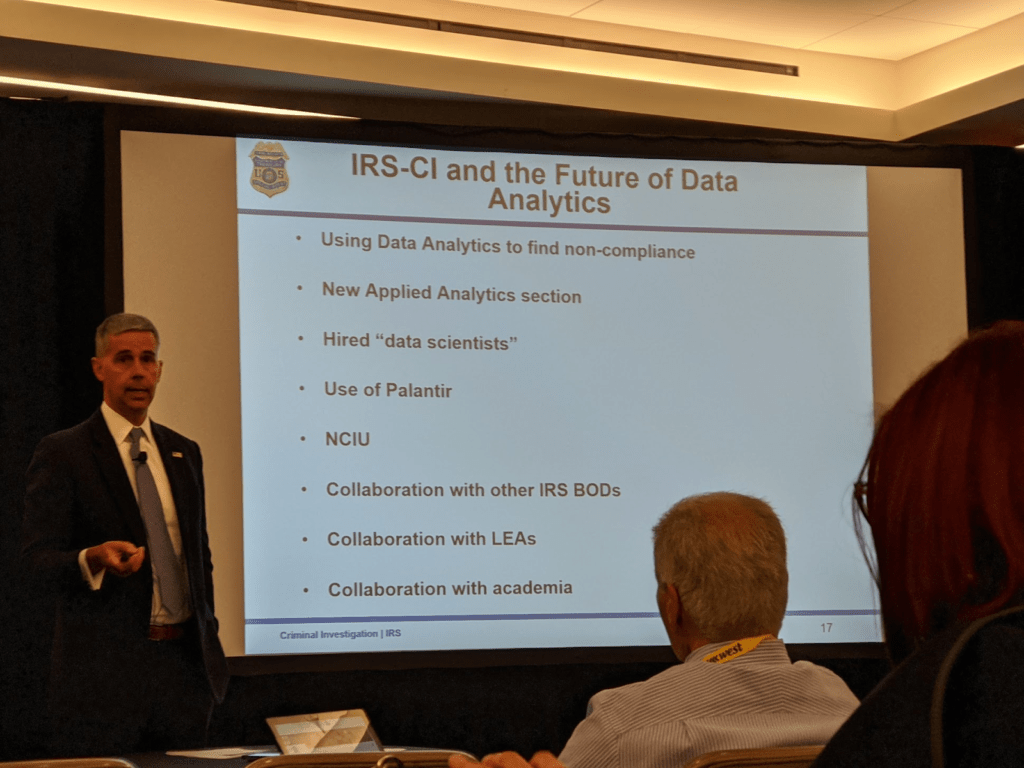

IRS Chief of Criminal Investigations, Don Fort, presents on Data Analytics strategies used to catch cryptocurrency tax fraud

Cryptocurrency is similar to cash, such as US Dollars ($) or Euro (€), but exclusively digital so there are no physical bills or coins. The first mainstream cryptocurrency, Bitcoin, was created by a pseudonymous person (or persons) called Satoshi Nakamoto in 2008. Since then, thousands of cryptocurrencies have emerged like Ether, Zcash, and more.

In addition to being completely electronic, cryptocurrency has another unique property compared to all other forms of money: it is not controlled by any central authority. In the Bitcoin whitepaper, Satoshi describes how the decentralized protocol works without requiring any governments, central banks, or financial institutions.

How can you tax a decentralised virtual something? Is cryptocurrency really taxed? Yes. In most jurisdictions around the world, including in the US, UK, Canada, Australia, India, the tax authorities tax cryptocurrency transactions.

Most countries, like the US, tax cryptocurrency as property. Therefore if the asset appreciates in value and you sell/trade/use it for profit, the gains are taxed like capital gains. If the asset depreciates in value and you sell/trade/use it at a loss, you may be able to deduct the losses against other capital gains to reduce your taxes.

The amount of tax depends on how much capital gain/loss there has been on the asset, how long you have held the asset, and the specific regulations in your country/jurisdiction. Because each taxable event may create a capital gain, you need to know the date, cost basis, sale value, and any fees associated with each transaction.

How Do Tax Authorities Know About My Cryptocurrency?

Tax authorities such as the IRS, ATO, CRA, HMRC, and others use a variety of techniques to track cryptocurrency transactions and enforce tax compliance. For starters, the IRS has subpoenaed domestic and international cryptocurrency exchanges such as Coinbase and Bitstamp for user transaction information. This has lead to at least tens of thousands of cryptocurrency users’ transaction information being shared directly with the tax authorities.

In addition, tax authorities, like the IRS, use data analytics tools such as Chainanalysis and Palantir and team up with external “Data Scientist” like Artefaktum to pinpoint cryptocurrency users and tie their identity from a regulated cryptocurrency exchange to their off-exchange wallets and transactions (including multiple layers removed from the exchange).

The IRS and other tax authorities also partner and share data with other governmental bodies, academic institutions, and international governments to share information about cryptocurrency usage.

However, if you don’t file your cryptocurrency taxes in the US (the IRS requires that you file your taxes, in some cases, even if you owe zero taxes or should be owed a refund, you are still required to file your taxes) you will be in trouble very soon. Failure to file can result in fees, penalties, interest, confiscated refunds, audits, and even jail time.